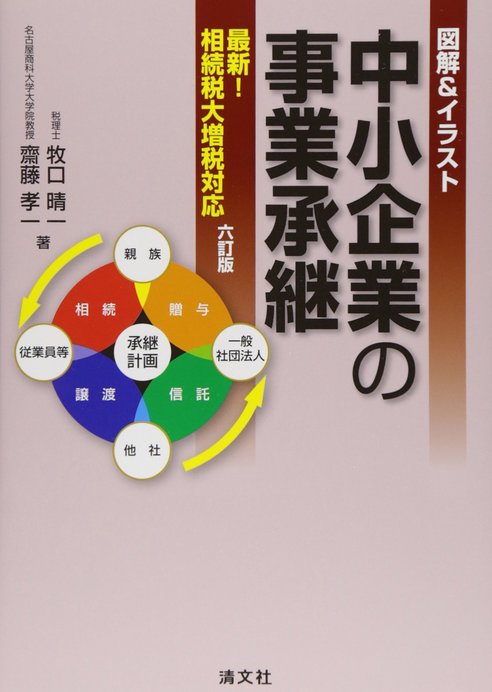

SME Business Succession with Illustrations & Charts, 6th Edition

Explains the basics, applications, and comprehensive measures of business succession concerning "property rights" and "management rights". A popular and latest edition that incorporates various latest information, abundant illustrations and illustrations, focusing on four methods such as succession to relatives, succession to employees, M & A, trust.

・ Group corporate tax compliant version ・ "Debt deduction" for inheritance tax at partnership companies

・ Tax saving by utilizing fixed-term land lease with family companies ・ Countermeasures for small-scale evaluation of residential land!

・ Can consumption tax refund for APA-Man construction still be done?

・ Group corporate taxation ・ Consolidated tax payment ・ Deferred payment of tax ・ Special cases of residuals are also used ・ Asset owners are "asset managers" utilizing family companies!

With tax accountant damages, you can understand the small-scale residential land with the most mistakes in an easy-to-understand way! You can still use "sunlight" and "rental container" for both business and residential use! Trust, general incorporated association, medical corporation. With 10% consumption tax, you can increase the amount of tax refund that you can still do! Measures for fusion (class stocks, partnership companies, change of articles of incorporation) & insurance in response to revision of the Companies Act. Utilization of fixed-term land lease rights that tax accountants do not know.

Download

Download

Infosession

Infosession

Application

Application

Open Campus

Open Campus